GMWKF

Games Workshop Group PLC

Price Chart

Latest Quote

$235.00

Current Price| Previous Close | $237.00 |

| Open | $240.00 |

| Day High | $240.00 |

| Day Low | $235.00 |

| Volume | 28 |

Stock Information

| Quarterly Dividend / Yield | $4.64 / 1.89% |

| Shares Outstanding | 33.04M |

| Total Debt | $68.06M |

| Cash Equivalents | $233.84M |

| Revenue | $888.49M |

| Net Income | $282.09M |

| Sector | Consumer Cyclical |

| Industry | Leisure |

| Market Cap | $7.77B |

| P/E Ratio | 27.29 |

| EPS (TTM) | $8.61 |

| Exchange | PNK |

📊 Custom Metrics & Score

Score: 32/42| Debt to Equity | 0.16 |

| Debt to Earnings | 0.10 |

| Current Ratio | 3.58 |

| Quick Ratio | 2.08 |

| Avg Revenue Growth | 12.22% |

| Profit Margin | 31.76% |

| Return on Equity | 69.84% |

| Avg FCF Growth | 32.88% |

| FCF Yield | 2.66% |

Recent Price History

| Date | Close | Volume |

|---|---|---|

| 2026-02-02 | $235.00 | 28 |

| 2026-01-30 | $245.96 | 300 |

| 2026-01-29 | $245.00 | 200 |

| 2026-01-28 | $247.00 | 200 |

| 2026-01-27 | $247.50 | 200 |

| 2026-01-26 | $249.50 | 100 |

| 2026-01-23 | $246.40 | 100 |

| 2026-01-22 | $240.01 | 600 |

| 2026-01-21 | $248.00 | 300 |

| 2026-01-20 | $249.38 | 400 |

| 2026-01-16 | $254.44 | 200 |

| 2026-01-15 | $255.00 | 500 |

| 2026-01-14 | $263.15 | 2,100 |

| 2026-01-13 | $254.00 | 300 |

| 2026-01-12 | $255.00 | 200 |

| 2026-01-09 | $251.37 | 100 |

| 2026-01-08 | $254.32 | 400 |

| 2026-01-07 | $242.34 | 200 |

| 2026-01-06 | $250.08 | 200 |

| 2026-01-05 | $250.55 | 500 |

About Games Workshop Group PLC

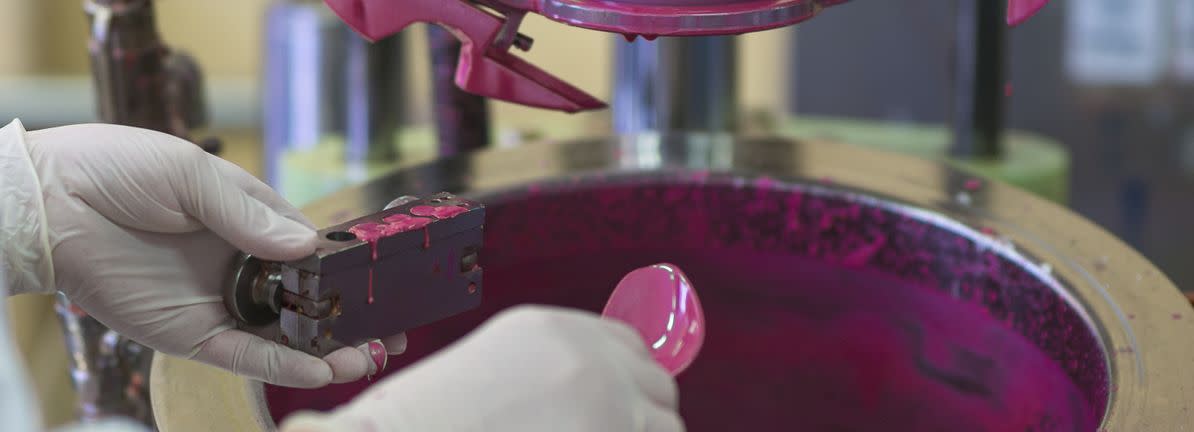

Games Workshop Group PLC, together with its subsidiaries, engages in the design, manufacture, distribution, and sale of fantasy miniature figures and games in the United Kingdom, Continental Europe, North America, Australia, New Zealand, Asia, and internationally. It operates in two segments, Core and Licensing. The company offers games under the Warhammer 40,000, Warhammer: The Horus Heresy, Warhammer: The Old World, Warhammer: Age of Sigmar, Necromunda, Blood Bowl, and the Lord of the Rings brand names. It also publishes short stories, audio dramas, full length novels, and audio books under the Black Library name; and produces motion picture, video, and television programs. In addition, the company provides merchandise, apparel, video games accessories, display art, and action figures; and design, produces, and sells various books and accessories, as well as plastic and resin kits, and painting guides. Further, it grants licenses to third parties for the development of video games, PC games, media and other products; and engages in the magazine newsstand and trustee businesses. It offers its products through its retail stores, independent retailers, and web stores. The company was incorporated in 1991 and is headquartered in Nottingham, the United Kingdom.

📰 Latest News

What Is Games Workshop Group PLC's (LON:GAW) Share Price Doing?

Simply Wall St. • 2026-01-24T07:33:11Z

Games Workshop price target raised to 21,850 GBp from 21,000 GBp at Jefferies

TipRanks • 2026-01-17T13:27:39Z

FTSE 100 reshuffle 2025: Burberry, Games Workshop and British Land join as WPP, Frasers and B&M exit

Yahoo Finance UK • 2026-01-02T16:04:36ZFTSE 100 up but mixed US jobs data tempers gains

PA Media: Money • 2025-11-20T17:29:41Z

Games Workshop shares surge after eyeing profit and sales growth

PA Media: Money • 2025-11-20T09:43:31Z

Top UK Dividend Stocks To Consider In November 2025

Simply Wall St. • 2025-11-19T06:31:53Z

Games Workshop Group (LON:GAW) jumps 3.8% this week, though earnings growth is still tracking behind three-year shareholder returns

Simply Wall St. • 2025-11-06T12:56:47Z

Top UK Dividend Stocks To Consider In October 2025

Simply Wall St. • 2025-10-21T06:31:54Z

Games Workshop Group PLC's (LON:GAW) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

Simply Wall St. • 2025-10-14T09:39:04Z

Top UK Dividend Stocks To Watch In October 2025

Simply Wall St. • 2025-10-09T06:31:46Z

Income Statement (Annual)

Revenue

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Reconciled Cost Of Revenue | $172,500,000 | $151,200,000 | $149,200,000 | $127,400,000 |

| Cost Of Revenue | $172,500,000 | $151,200,000 | $149,200,000 | $127,400,000 |

| Total Revenue | $617,500,000 | $525,700,000 | $470,800,000 | $414,800,000 |

| Operating Revenue | $617,500,000 | $525,700,000 | $470,800,000 | $414,800,000 |

Expenses

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Interest Expense | $1,400,000 | $1,300,000 | $900,000 | $800,000 |

| Total Expenses | $356,200,000 | $323,900,000 | $300,600,000 | $257,700,000 |

| Net Non Operating Interest Income Expense | $1,500,000 | $1,200,000 | $400,000 | $-600,000 |

| Interest Expense Non Operating | $1,400,000 | $1,300,000 | $900,000 | $800,000 |

| Operating Expense | $183,700,000 | $172,700,000 | $151,400,000 | $130,300,000 |

| Selling And Marketing Expense | $87,800,000 | $86,200,000 | $77,300,000 | $66,300,000 |

| General And Administrative Expense | $95,900,000 | $86,500,000 | $74,100,000 | $64,000,000 |

Income & Earnings

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Net Income From Continuing Operation Net Minority Interest | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Net Interest Income | $1,500,000 | $1,200,000 | $400,000 | $-600,000 |

| Interest Income | $2,900,000 | $2,500,000 | $1,300,000 | $200,000 |

| Normalized Income | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Net Income From Continuing And Discontinued Operation | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Total Operating Income As Reported | $261,300,000 | $201,800,000 | $170,200,000 | $157,100,000 |

| Net Income Common Stockholders | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Net Income | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Net Income Including Noncontrolling Interests | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Net Income Continuous Operations | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Pretax Income | $262,800,000 | $203,000,000 | $170,600,000 | $156,500,000 |

| Interest Income Non Operating | $2,900,000 | $2,500,000 | $1,300,000 | $200,000 |

| Operating Income | $261,300,000 | $201,800,000 | $170,200,000 | $157,100,000 |

| Gross Profit | $445,000,000 | $374,500,000 | $321,600,000 | $287,400,000 |

Per Share Metrics

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Diluted EPS | $5.93 | $4.58 | $4.09 | $3.91 |

| Basic EPS | $5.95 | $4.59 | $4.10 | $3.91 |

Other

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Tax Effect Of Unusual Items | $0 | $0 | $0 | $0 |

| Tax Rate For Calcs | $0 | $0 | $0 | $0 |

| Normalized EBITDA (Bullshit earnings) | $308,100,000 | $243,300,000 | $211,000,000 | $192,100,000 |

| Reconciled Depreciation | $43,900,000 | $39,000,000 | $39,500,000 | $34,800,000 |

| EBITDA (Bullshit earnings) | $308,100,000 | $243,300,000 | $211,000,000 | $192,100,000 |

| EBIT | $264,200,000 | $204,300,000 | $171,500,000 | $157,300,000 |

| Diluted Average Shares | $33,041,000 | $32,977,000 | $32,898,000 | $32,873,000 |

| Basic Average Shares | $32,963,000 | $32,935,000 | $32,881,000 | $32,813,000 |

| Diluted NI Availto Com Stockholders | $196,100,000 | $151,100,000 | $134,700,000 | $128,400,000 |

| Otherunder Preferred Stock Dividend | $0 | $0 | $0 | $0 |

| Tax Provision | $66,700,000 | $51,900,000 | $35,900,000 | $28,100,000 |

| Selling General And Administration | $183,700,000 | $172,700,000 | $151,400,000 | $130,300,000 |

Balance Sheet (Annual)

Assets

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Net Tangible Assets | $255,800,000 | $227,200,000 | $212,500,000 | $207,700,000 |

| Total Assets | $383,000,000 | $351,300,000 | $326,800,000 | $321,100,000 |

| Total Non Current Assets | $155,500,000 | $159,400,000 | $152,800,000 | $167,300,000 |

| Non Current Deferred Taxes Assets | $12,300,000 | $12,900,000 | $12,000,000 | $17,800,000 |

| Goodwill And Other Intangible Assets | $25,000,000 | $24,200,000 | $22,600,000 | $27,000,000 |

| Other Intangible Assets | $23,600,000 | $22,800,000 | $21,200,000 | $25,600,000 |

| Current Assets | $227,500,000 | $191,900,000 | $174,000,000 | $153,800,000 |

| Other Current Assets | $200,000 | $-200,000 | - | - |

| Inventory | $39,500,000 | $42,400,000 | $33,000,000 | $38,400,000 |

| Other Receivables | $34,600,000 | $26,700,000 | $25,700,000 | $31,000,000 |

| Taxes Receivable | $3,100,000 | $4,300,000 | $14,500,000 | $4,400,000 |

| Accounts Receivable | $17,500,000 | $11,100,000 | $10,600,000 | $8,600,000 |

| Allowance For Doubtful Accounts Receivable | $-300,000 | $-400,000 | $-200,000 | $-500,000 |

| Gross Accounts Receivable | $17,800,000 | $11,500,000 | $10,800,000 | $9,100,000 |

| Cash Cash Equivalents And Short Term Investments | $132,600,000 | $107,600,000 | $90,200,000 | $71,400,000 |

| Cash And Cash Equivalents | $132,600,000 | $107,600,000 | $90,200,000 | $71,400,000 |

| Cash Financial | $132,600,000 | $107,600,000 | $90,200,000 | $71,400,000 |

| Other Non Current Assets | - | - | - | $-100,000 |

Debt

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Total Debt | $45,200,000 | $47,200,000 | $49,900,000 | $48,900,000 |

| Long Term Debt And Capital Lease Obligation | $34,000,000 | $37,200,000 | $40,000,000 | $39,700,000 |

| Long Term Debt | $0 | $0 | $0 | $0 |

| Current Debt And Capital Lease Obligation | $11,200,000 | $10,000,000 | $9,900,000 | $9,200,000 |

| Current Debt | $0 | $0 | $0 | - |

Liabilities

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Total Liabilities Net Minority Interest | $102,200,000 | $99,900,000 | $91,700,000 | $86,400,000 |

| Total Non Current Liabilities Net Minority Interest | $38,600,000 | $41,500,000 | $43,500,000 | $41,800,000 |

| Non Current Deferred Taxes Liabilities | $1,600,000 | $1,700,000 | $1,400,000 | $0 |

| Current Liabilities | $63,600,000 | $58,400,000 | $48,200,000 | $44,600,000 |

| Payables | $30,700,000 | $27,200,000 | $22,700,000 | $19,400,000 |

| Other Payable | $12,800,000 | $10,900,000 | $9,300,000 | $7,900,000 |

| Total Tax Payable | $4,600,000 | $3,800,000 | $3,900,000 | $2,000,000 |

| Accounts Payable | $13,300,000 | $12,500,000 | $9,500,000 | $9,500,000 |

Equity

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Common Stock Equity | $280,800,000 | $251,400,000 | $235,100,000 | $234,700,000 |

| Total Equity Gross Minority Interest | $280,800,000 | $251,400,000 | $235,100,000 | $234,700,000 |

| Stockholders Equity | $280,800,000 | $251,400,000 | $235,100,000 | $234,700,000 |

| Retained Earnings | $255,200,000 | $227,400,000 | $213,200,000 | $213,900,000 |

| Long Term Equity Investment | $0 | $0 | $0 | $0 |

Other

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Ordinary Shares Number | $32,971,750 | $32,952,000 | $32,913,994 | $32,839,832 |

| Share Issued | $32,971,750 | $32,952,000 | $32,913,994 | $32,839,832 |

| Tangible Book Value | $255,800,000 | $227,200,000 | $212,500,000 | $207,700,000 |

| Invested Capital | $280,800,000 | $251,400,000 | $235,100,000 | $234,700,000 |

| Working Capital | $163,900,000 | $133,500,000 | $125,800,000 | $109,200,000 |

| Capital Lease Obligations | $45,200,000 | $47,200,000 | $49,900,000 | $48,900,000 |

| Total Capitalization | $280,800,000 | $251,400,000 | $235,100,000 | $234,700,000 |

| Additional Paid In Capital | $23,500,000 | $21,700,000 | $19,000,000 | $16,400,000 |

| Capital Stock | $1,600,000 | $1,600,000 | $1,600,000 | $1,600,000 |

| Common Stock | $1,600,000 | $1,600,000 | $1,600,000 | $1,600,000 |

| Non Current Accrued Expenses | $1,100,000 | $700,000 | $500,000 | $600,000 |

| Long Term Capital Lease Obligation | $34,000,000 | $37,200,000 | $40,000,000 | $39,700,000 |

| Long Term Provisions | $1,900,000 | $1,900,000 | $1,600,000 | $1,500,000 |

| Current Capital Lease Obligation | $11,200,000 | $10,000,000 | $9,900,000 | $9,200,000 |

| Current Provisions | $900,000 | $900,000 | $900,000 | $800,000 |

| Investmentsin Subsidiariesat Cost | $0 | $0 | $0 | $0 |

| Goodwill | $1,400,000 | $1,400,000 | $1,400,000 | $1,400,000 |

| Net PPE | $108,900,000 | $102,600,000 | $104,600,000 | $103,100,000 |

| Accumulated Depreciation | $-129,900,000 | $-116,100,000 | $-108,600,000 | $-95,700,000 |

| Gross PPE | $238,800,000 | $218,700,000 | $213,200,000 | $198,800,000 |

| Other Properties | $68,500,000 | $61,500,000 | $55,000,000 | $48,200,000 |

| Machinery Furniture Equipment | $89,000,000 | $80,400,000 | $78,600,000 | $72,500,000 |

| Buildings And Improvements | $43,900,000 | $45,800,000 | $48,800,000 | $47,700,000 |

| Land And Improvements | $37,400,000 | $31,000,000 | $30,800,000 | $30,400,000 |

| Properties | $0 | $0 | $0 | $0 |

| Finished Goods | $36,600,000 | $39,300,000 | $30,400,000 | $35,100,000 |

| Work In Process | $2,100,000 | $2,300,000 | $1,500,000 | $1,900,000 |

| Raw Materials | $800,000 | $800,000 | $1,100,000 | $1,400,000 |

| Treasury Shares Number | - | $0 | $0 | $0 |

| Non Current Pension And Other Postretirement Benefit Plans | - | - | - | $1,500,000 |

| Pensionand Other Post Retirement Benefit Plans Current | - | - | - | $800,000 |

Cash Flow Statement (Annual)

Free Cash Flow

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Free Cash Flow | $206,500,000 | $163,600,000 | $164,400,000 | $89,200,000 |

Operating Activities

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Operating Cash Flow | $247,400,000 | $196,200,000 | $192,700,000 | $121,500,000 |

Investing Activities

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Capital Expenditure | $-40,900,000 | $-32,600,000 | $-28,300,000 | $-32,300,000 |

| Investing Cash Flow | $-38,000,000 | $-30,100,000 | $-27,100,000 | $-32,100,000 |

| Capital Expenditure Reported | $-16,400,000 | $-15,400,000 | $-13,100,000 | $-13,900,000 |

Financing Activities

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Issuance Of Capital Stock | $1,800,000 | $2,700,000 | $2,600,000 | $1,800,000 |

| Financing Cash Flow | $-183,300,000 | $-148,500,000 | $-146,600,000 | $-103,600,000 |

| Cash Dividends Paid | $-171,400,000 | $-138,300,000 | $-136,500,000 | $-93,500,000 |

| Net Common Stock Issuance | $1,800,000 | $2,700,000 | $2,600,000 | $1,800,000 |

| Common Stock Issuance | $1,800,000 | $2,700,000 | $2,600,000 | $1,800,000 |

Other

| Metric | 2025-05-31 | 2024-05-31 | 2023-05-31 | 2022-05-31 |

|---|---|---|---|---|

| Repayment Of Debt | $0 | $0 | - | - |

| End Cash Position | $132,600,000 | $107,600,000 | $90,200,000 | $71,400,000 |

| Beginning Cash Position | $107,600,000 | $90,200,000 | $71,400,000 | $85,200,000 |

| Effect Of Exchange Rate Changes | $-1,100,000 | $-200,000 | $-200,000 | $400,000 |

| Changes In Cash | $26,100,000 | $17,600,000 | $19,000,000 | $-14,200,000 |

| Interest Paid Cff | $-1,400,000 | $-1,100,000 | $-900,000 | $-800,000 |

| Net Issuance Payments Of Debt | $0 | $0 | - | - |

| Net Long Term Debt Issuance | $0 | $0 | - | - |

| Long Term Debt Payments | $0 | $0 | - | - |

| Interest Received Cfi | $2,900,000 | $2,500,000 | $1,200,000 | $200,000 |

| Net Intangibles Purchase And Sale | $-500,000 | $-1,600,000 | $-400,000 | $-1,400,000 |

| Purchase Of Intangibles | $-500,000 | $-1,600,000 | $-400,000 | $-1,400,000 |

| Net PPE Purchase And Sale | $-24,000,000 | $-15,600,000 | $-14,800,000 | $-17,000,000 |

| Purchase Of PPE | $-24,000,000 | $-15,600,000 | $-14,800,000 | $-17,000,000 |

| Taxes Refund Paid | $-64,100,000 | $-41,700,000 | $-39,000,000 | $-37,700,000 |

| Change In Working Capital | $3,200,000 | $-7,900,000 | $18,600,000 | $-35,900,000 |

| Change In Payable | $4,600,000 | $9,400,000 | $4,200,000 | $-2,200,000 |

| Change In Inventory | $2,500,000 | $-10,000,000 | $6,000,000 | $-12,200,000 |

| Change In Receivables | $-4,000,000 | $-7,600,000 | $8,100,000 | $-21,500,000 |

| Other Non Cash Items | $-1,500,000 | $-1,200,000 | $-400,000 | $600,000 |

| Stock Based Compensation | $1,300,000 | $1,200,000 | $1,000,000 | $1,600,000 |

| Depreciation And Amortization | $43,900,000 | $39,000,000 | $39,500,000 | $34,800,000 |

| Amortization Cash Flow | $14,600,000 | $12,700,000 | $13,900,000 | $11,700,000 |

| Depreciation | $29,300,000 | $26,300,000 | $25,600,000 | $23,100,000 |

| Net Foreign Currency Exchange Gain Loss | $200,000 | $1,100,000 | $-1,600,000 | $0 |

| Gain Loss On Sale Of PPE | $400,000 | $100,000 | $400,000 | $300,000 |

| Net Income From Continuing Operations | $262,800,000 | $203,000,000 | $170,600,000 | $156,500,000 |